[ad_1]

[ad_1]

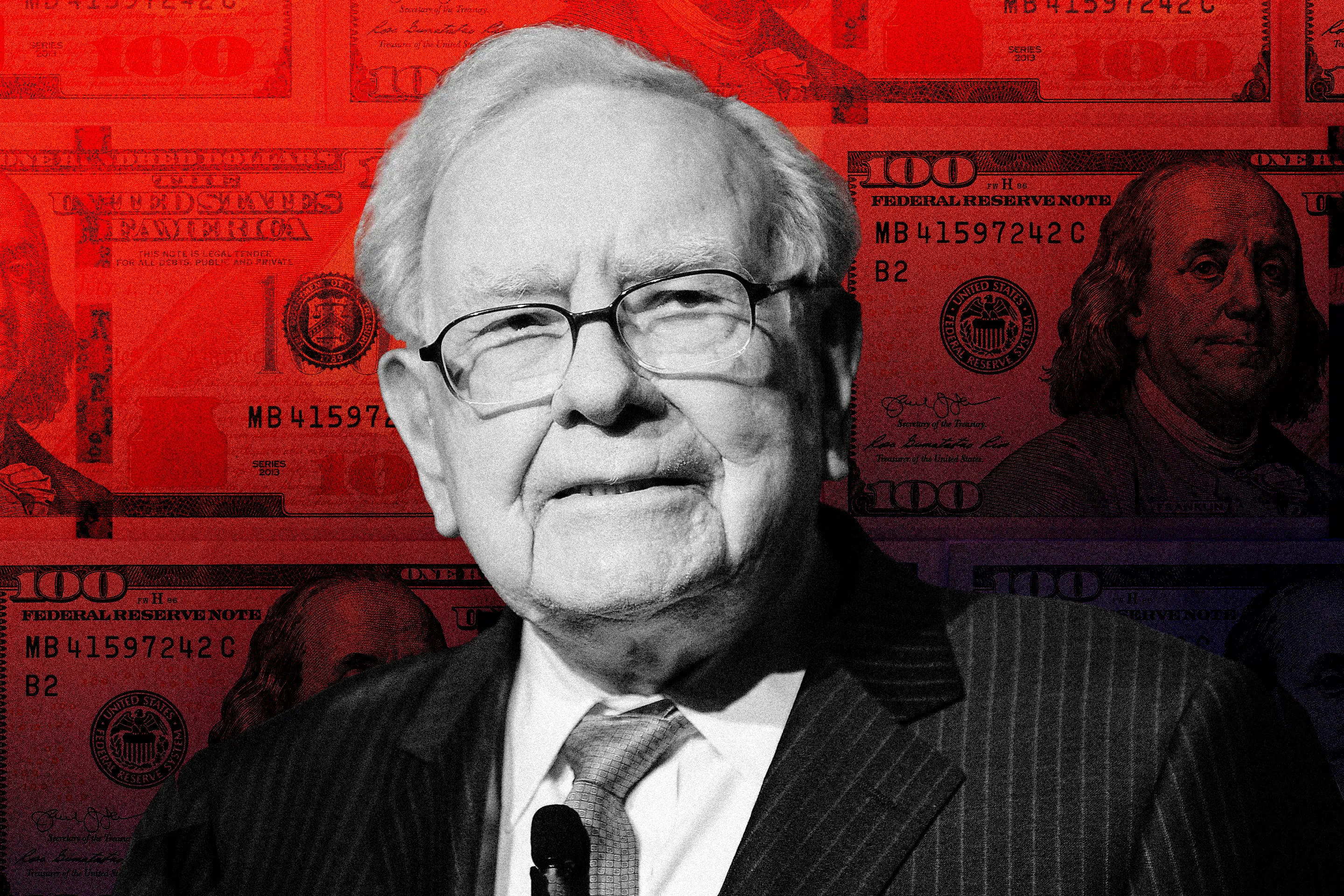

Famed investor Warren Buffett says People ought to brace for extra financial institution failures — however they shouldn’t fear about shedding their deposits. He additionally has some (extra) unkind issues to say about bitcoin.

In a wide-ranging interview with CNBC on Wednesday, Buffett weighed in on the current turmoil within the banking sector, which was sparked by the sudden collapse of Silicon Valley Financial institution (SVB) final month. Whereas “we’re not via with financial institution failures,” the Berkshire Hathaway chairman and CEO mentioned, “no person goes to lose cash on a deposit in a U.S. financial institution.”

Within the aftermath of the collapse of SVB and Signature Financial institution a number of days later, the federal authorities stepped in to ensure that each one deposits can be protected, even these past the Federal Deposit Insurance coverage Company (FDIC)’s traditional $250,000 restrict.

Buffett’s feedback point out that he believes the federal government will proceed to guard depositors, even when the instability within the banking sector persists. “Dumb selections” made by banks shouldn’t panic “the entire citizenry of the US about one thing they don’t have to be panicked about,” he mentioned.

However the identical can’t be mentioned for buyers who personal financial institution shares — the federal government is “not gonna save the stockholder,” Buffett added.

Buffett says bitcoin investments are like playing

Buffett additionally reiterated his stance on bitcoin, the most well-liked cryptocurrency. “It’s a playing token,” he mentioned of bitcoin on CNBC. “It doesn’t have any worth, however that doesn’t cease individuals from desirous to play a roulette wheel.”

The acclaimed chairman and CEO of Berkshire Hathaway, recognized for being an excellent and disciplined long-term investor, has been a steadfast critic of bitcoin and different cryptos. Previously, Buffett has described bitcoin as "rat poison squared."

Cryptocurrencies noticed a main rally within the first quarter of the yr, with bitcoin costs rising greater than 80% since January (although costs are nonetheless down greater than 50% from their all-time highs in 2021). Whereas it’s potential that these beneficial properties may proceed, consultants say rising rates of interest and the current banking disaster may weigh on costs transferring ahead.

Monetary advisors usually suggest preserving solely a really small portion of your portfolio — 5% and even much less — in dangerous investments like digital currencies, in the event you do select to take a position. Due to how unpredictable and risky digital property may be, it is best to solely make investments what you're ready to lose.

Extra from Cash:

6 Finest Crypto Exchanges of April 2023

Why Shares May Fall Once more as Firms Begin Reporting Earnings

0 Comments