[ad_1]

[ad_1]

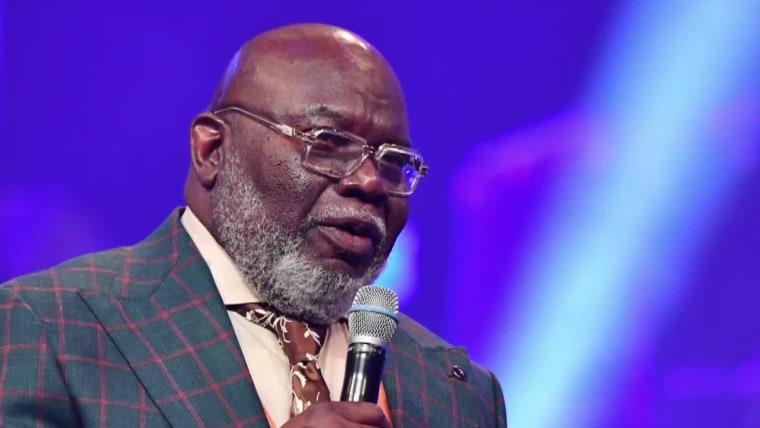

Bishop T.D. Jakes, arguably probably the most well-known Black non secular chief in america and whose Dallas church, The Potter’s Home, ranks among the many nation’s largest congregations, has introduced a brand new 10-year deal between T.D. Jakes Group and Wells Fargo to construct mixed-income communities in underserved neighborhoods. Although the partnership is just not along with his church, Jakes continues to be finest referred to as a pastor, and in working with a monetary establishment that’s been repeatedly accused of racist lending practices, Jakes will probably be hurting a Black group he says he needs to assist. Certainly, his partnership with Wells Fargo is tantamount to his working with the fox to raid the henhouse.

In working with a monetary establishment that’s been repeatedly accused of racist lending practices, Jakes will probably be hurting a Black group he says he needs to assist.

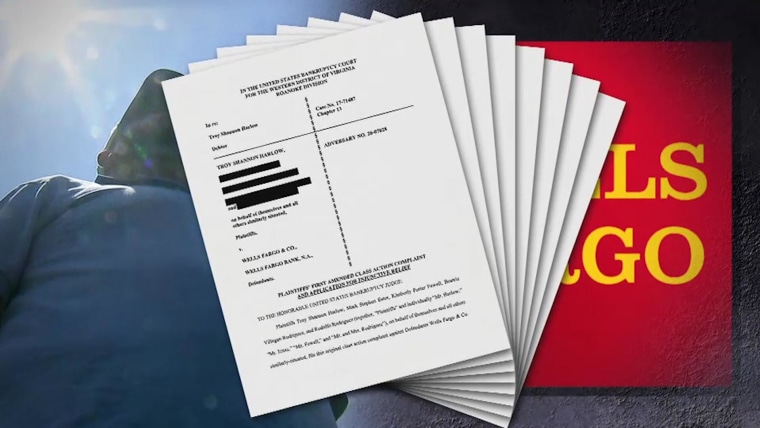

For nearly 20 years, Wells Fargo has had an abysmal document within the African American group concerning mortgages and loans. In keeping with federal prosecutors, beginning 4 years earlier than the 2008 monetary disaster that brought about the Nice Recession, Wells Fargo, the fourth largest financial institution within the U.S., “discriminated by steering roughly 4,000 African-American and Hispanic wholesale debtors, in addition to extra retail debtors, into subprime mortgages when non-Hispanic white debtors with comparable credit score profiles acquired prime loans.” Baltimore metropolis officers complained at the moment that Wells Fargo’s insurance policies had pushed lots of of debtors in that metropolis into foreclosures.

4 years later, in 2012, Wells Fargo was ordered by the Justice Division to pay $175 million to settle allegations that it discriminated towards African American and Hispanic debtors between 2004 and 2009. Wells Fargo denied that it had really discriminated and mentioned in a press release that “Wells Fargo is settling this matter solely for the aim of avoiding contested litigation with the DOJ.” The $175 million included $125 million to debtors who had been discriminated towards and $50 million “in direct down cost help to debtors in communities across the nation the place the division recognized giant numbers of discrimination victims and which had been arduous hit by the housing disaster.”

In 2018, the Nationwide Black Church Initiative, a coalition of 150,000 African American and Latino church buildings that fights racial disparities, introduced a nationwide boycott of Wells Fargo due to that historical past of pushing subprime loans on Black folks. However complaints towards the financial institution didn’t finish. In a class-action lawsuit filed in California in April 2022, Wells Fargo was as soon as once more accused of racist lending. In keeping with plaintiffs in that class-action lawsuit, Black mortgage candidates with excessive credit score scores got rates of interest that had been greater than white mortgage candidates with excessive credit score scores.

In denying these claims, Wells Fargo mentioned in a press release, “We're deeply disturbed by allegations of discrimination that we imagine don't stand as much as scrutiny ... These unfounded assaults on Wells Fargo stand in stark distinction to the corporate’s vital and long-term dedication to closing the minority homeownership hole.”

In March, a federal choose in Ohio held off approving a $94 million settlement between Wells Fargo and debtors who claimed the financial institution wrongly despatched their mortgages into forbearance as a result of, he wrote, the class-action lawsuit in California must be resolved first.

In 2018, the Nationwide Black Church Initiative, a coalition of 150,000 African American and Latino church buildings, introduced a nationwide boycott of Wells Fargo.

In a separate set of complaints that don’t allege racism, in January, the Client Monetary Safety Bureau introduced that Wells Fargo broke “federal client legal guidelines that apply to monetary merchandise, together with auto loans, mortgages, and financial institution accounts” and that it will be paying “$2 billion to prospects who had been harmed, plus a $1.7 billion high-quality that goes to the victims’ reduction fund.”

That’s nonetheless not all. In Might 2022, The New York Occasions quoted seven individuals who had labored or nonetheless had been working for Wells Fargo who mentioned they’d been instructed to give sham interviews to so-called “various” candidates after the corporate had already determined to rent another person. And a few shareholders have filed go well with towards Wells Fargo claiming that the sham interview coverage had damage the corporate’s popularity and inventory worth. In a written assertion to Bloomberg Regulation, a spokesperson mentioned, Wells Fargo “is deeply dedicated to range, fairness and inclusion. We disagree with the claims, and sit up for defending ourselves towards them.”

Regardless of what the corporate says in its statements about its dedication to truthful hiring practices and truthful lending practices, there seems to be a sample with Wells Fargo, one which the Nationwide Black Church Initiative thought was troubling sufficient to name for a boycott. Why, then, is Jakes partnering with a lender that has an abysmal document within the communities he says he needs to serve?

In an April 27 look on CBS Mornings, the place he introduced the partnership, Jakes was requested in regards to the “unlawful overdraft charges, unlawful charges tied to automotive loans, unlawful charges tied to mortgages” that led to the $3.7 billion settlement with the CFPB. He mentioned these dangerous practices had been “precisely the reservations that I had with them as nicely. Initially, a number of years in the past, after they talked to me, I'd not do enterprise with them for these very causes.”

Jakes mentioned, “That settlement that got here out got here from the earlier administration. They've a brand new chief now. They've a brand new administration and so they're starting to proper a number of the wrongs.” He mentioned, “Wells Fargo stood up and mentioned, , I am prepared to make this unlikely alliance, this very distinctive alliance.” Then Jakes referred to as consideration to his guide “Disruptive Pondering” and mentioned that “this disruptive alliance between us is designed to raise up underserved and underrepresented communities.”

Jakes has identified that Wells Fargo is partnering with T.D. Jakes Group, not The Potter’s Home, his church. In keeping with a information launch, T.D. Jakes Group consists of T.D. Jakes Actual Property Ventures, TDJ Enterprises and T.D. Jakes Basis. T.D. Jakes Actual Property Ventures has bought about 100 acres at Fort McPherson outdoors of Atlanta that would be the first a part of the mixed-income group Jakes intends to construct.

Jakes’ description of Wells Fargo makes it sound as if the lender has an altruistic motivation.

Jakes’ description of Wells Fargo makes it sound as if the lender has an altruistic motivation. However for a lender with such an abysmal historical past with Black folks, this partnership with Jakes offers Wells Fargo legitimacy.

Jakes is a family identify for hundreds of thousands of African American Christians and others who've listened to his sermons and seen him with work together with Hollywood stars. Jakes’ endorsement is more likely to be particularly sturdy for girls who had been nurtured by his “Lady, Thou Artwork Loosed” conferences and his guide and film of the identical identify. What’s a couple of million dollars to Wells Fargo if it means rehabbing its picture within the African American non secular group by linking itself to a well known pastor?

Wells Fargo CEO Charlie Scharf is identical CEO who in 2020 mentioned there was a a scarcity of Black workers at Wells Fargo resulting from a “restricted expertise pool." Now he’s promising to take a position as much as a billion dollars to fund a wide range of initiatives fostering group growth with Jakes. He additionally simply occurs to be showing at Jakes’ Worldwide Management summit this week.

When a reporter on CBS Mornings requested Jakes what he’s getting out of the partnership, he mentioned, “First, one main factor for me is legacy. You recognize, it is a legacy piece for me. I wish to give again. I wish to do one thing for individuals who have been loyal and trustworthy to me and those who I do know and love.”

However the legacy of prosperity pastors — and Jakes is among the most outstanding — is the issue. The wedding of conservative Christian values and finance is an previous story, and it usually doesn't end up nicely. Previously, we’ve seen well-meaning believers get fleeced by pastors touting monetary freedom. That is the prosperity gospel in motion. The prosperity by no means appears to succeed in the individuals who want it.

T.D. Jakes has lengthy regarded himself as a profitable businessman, and he clearly is, however by coming into a partnership with an organization with such a racist historical past, the nation’s most seen Black preacher places himself in questionable firm.

0 Comments