[ad_1]

[ad_1]

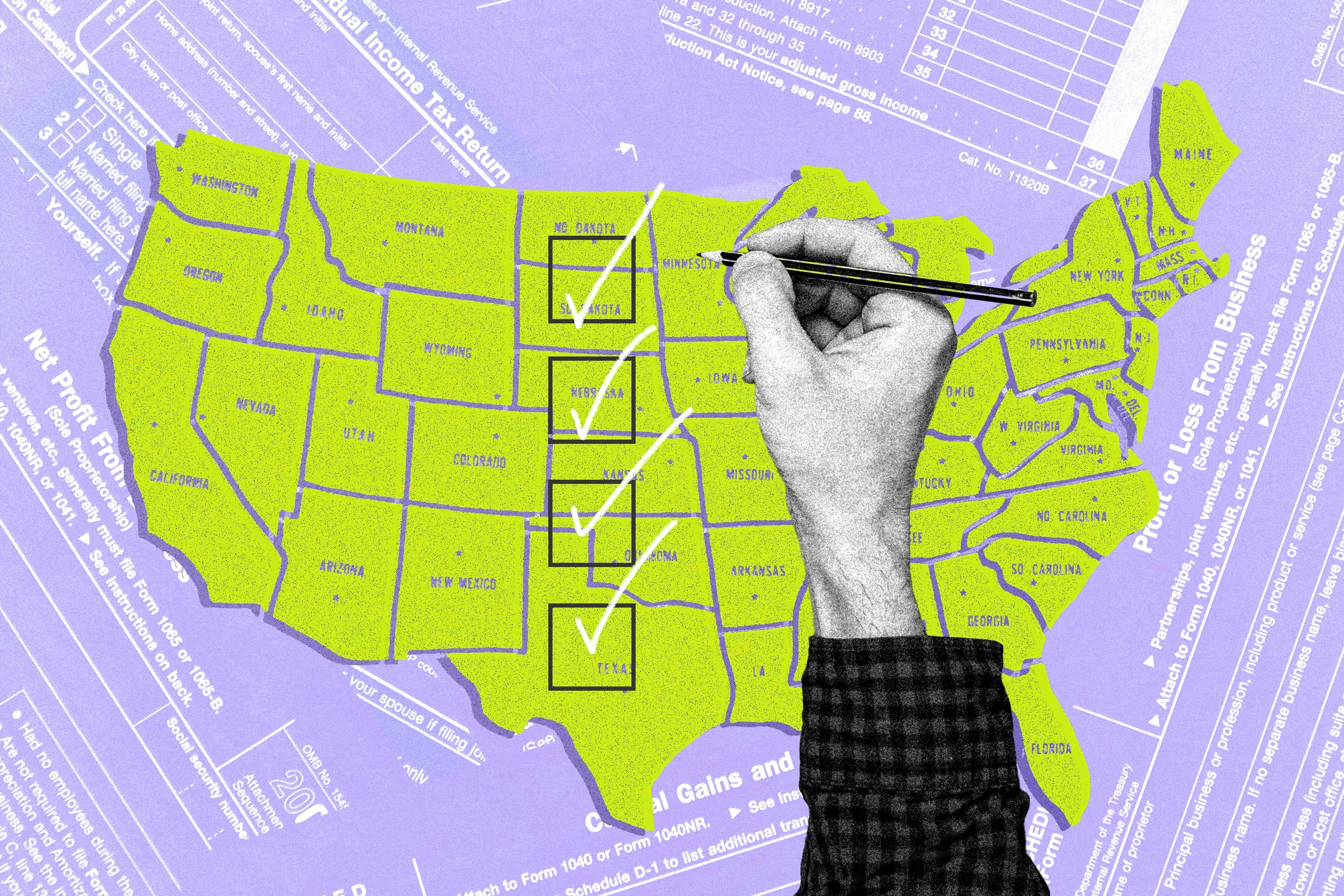

By now, you have in all probability memorized the truth that Tax Day normally falls on April 15. However for those who stay in one of many 41 states that cost state earnings taxes on wages, you might need a special due date to take care of this yr.

Though the overwhelming majority of states use the federal deadline for his or her particular person earnings tax returns, not all do. Hawaii, for example, is giving its taxpayers an additional week to file their 2023 taxes. In Louisiana, folks could have till Might 15 to submit their state earnings tax returns and make any crucial funds.

This is a listing of when taxes are due in your state in 2024.

When is the deadline to file state taxes?

Alabama

Alabama state earnings taxes for 2023 have to be filed by April 15.

Arizona

Arizona state earnings taxes for 2023 have to be filed by April 15.

Arkansas

Arkansas state earnings taxes for 2023 have to be filed by April 15.

California

Arkansas state earnings taxes for 2023 have to be filed by April 15.

Colorado

Colorado state earnings taxes for 2023 have to be filed by April 15.

Connecticut

Connecticut state earnings taxes for 2023 have to be filed by April 15.

Delaware

Delaware state earnings taxes for 2023 have to be filed by April 30.

Georgia

Georgia state earnings taxes for 2023 have to be filed by April 15.

Hawaii

Hawaii state earnings taxes for 2023 have to be filed by April 22.

Idaho

Idaho state earnings taxes for 2023 have to be filed by April 15.

Illinois

Illinois state earnings taxes for 2023 have to be filed by April 15.

Indiana

Indiana state earnings taxes for 2023 have to be filed by April 15.

Iowa

Iowa state earnings taxes for 2023 have to be filed by April 30.

Kansas

Kansas state earnings taxes for 2023 have to be filed by April 15.

Kentucky

Kentucky state earnings taxes for 2023 have to be filed by April 15.

Louisiana

Louisiana state earnings taxes for 2023 have to be filed by Might 15.

Maine

Maine state earnings taxes for 2023 have to be filed by April 17.

Maryland

Maryland state earnings taxes for 2023 have to be filed by April 15.

Massachusetts

Massachusetts state earnings taxes for 2023 have to be filed by April 17.

Michigan

Michigan state earnings taxes for 2023 have to be filed by April 15.

Minnesota

Minnesota state earnings taxes for 2023 have to be filed by April 15.

Mississippi

Mississippi state earnings taxes for 2023 have to be filed by April 15.

Missouri

Missouri state earnings taxes for 2023 have to be filed by April 15.

Montana

Montana state earnings taxes for 2023 have to be filed by April 15.

Nebraska

Nebraska state earnings taxes for 2023 have to be filed by April 15.

New Jersey

New Jersey state earnings taxes for 2023 have to be filed by April 15.

New Mexico

New Mexico state earnings taxes for 2023 have to be filed by April 15 (April 30 if submitting electronically).

New York

New York state earnings taxes for 2023 have to be filed by April 15.

North Carolina

North Carolina state earnings taxes for 2023 have to be filed by April 15.

North Dakota

North Dakota state earnings taxes for 2023 have to be filed by April 15.

Ohio

Ohio state earnings taxes for 2023 have to be filed by April 15.

Oklahoma

Oklahoma state earnings taxes for 2023 have to be filed by April 15.

Oregon

Oregon state earnings taxes for 2023 have to be filed by April 15.

Pennsylvania

Pennsylvania state earnings taxes for 2023 have to be filed by April 15.

Rhode Island

Rhode Island state earnings taxes for 2023 have to be filed by April 15.

South Carolina

South Carolina state earnings taxes for 2023 have to be filed by April 15.

Utah

Utah state earnings taxes for 2023 have to be filed by April 15.

Vermont

Vermont state earnings taxes for 2023 have to be filed by April 15.

Virginia

Virginia state earnings taxes for 2023 have to be filed by Might 1.

West Virginia

West Virginia state earnings taxes for 2023 have to be filed by April 15.

Wisconsin

Wisconsin state earnings taxes for 2023 have to be filed by April 15.

How one can get a state tax extension

Should you suppose you will not be capable to file your state earnings taxes on time, you may seemingly want an extension.

Each state has barely completely different insurance policies round this. Locations like California and Alabama, for instance, grant automated extensions that give taxpayers an additional six months to file — however nonetheless require them to pay taxes owed by the unique due date. In states like Vermont and New York, folks should file particular extension requests with a view to get their submitting deadline moved to Oct. 15.

Go to the web site to your state's income, taxation or finance division to find out what the method is the place you reside.

Extra from Cash:

How to Get Free Tax Help From the IRS and Others

0 Comments